Key highlights

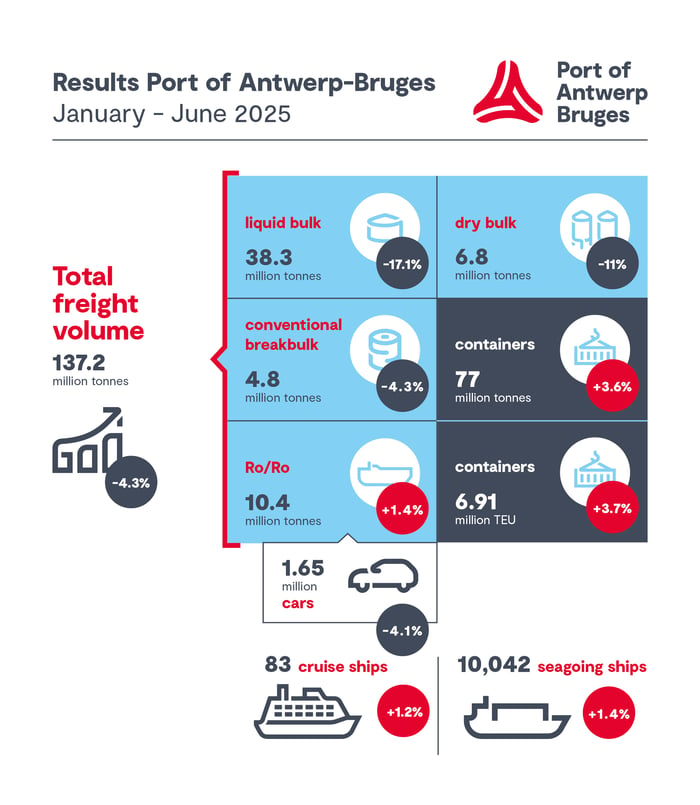

- Total cargo throughput down 4.3% in first half 2025

- Bulk volumes sharply lower, while container throughput increased

- Continued congestion is raising the pressure on terminals

- Increasing traffic with the US strengthened the Transatlantic position of Port of Antwerp-Bruges

Container growth vs capacity constraints

Container traffic held up well, increasing by 3.6% in tonnage (to 77 million tonnes) and 3.7% in TEUs (6.91 million TEUs) compared to H1 2024. However, persistent congestion puts terminal capacity under heavy strain; a challenge felt across Northwest Europe.

Several factors are contributing to the current congestion. Container ship arrivals remain irregular due to disruptions dating back to the Covid crisis, further exacerbated by rerouting around the Cape of Good Hope to avoid the Red Sea. The recent reshuffling of container alliances has temporarily led to simultaneous vessel calls and high cargo volumes. Poor schedule reliability is complicating terminal planning: containers remain on site longer, and vessels are arriving with increasingly large loads. As a result, average dwell times have increased to 7–8 days, compared to the usual 5 days. Overcrowded terminals require additional container movements, placing extra strain on personnel and equipment. On top of this, national union actions have added further operational pressure.

While waterside congestion and the associated waiting times for vessels remains currently relatively limited, the landside impact on terminals is critical. Therefore, additional space for container handling is necessary. The Extra Container Capacity Antwerp (ECA) project will address this, through the construction of a new dock and more efficient use of existing space.

Mixed picture in other segments

Liquid bulk throughput fell by 17.1% in H1 2025, mainly due to sharp declines in fuels, naphtha, and LNG. Geopolitical tensions, EU sanctions, and market overcapacity were key factors. Only LPG and kerosene showed growth. Chemical product throughput saw a rise of 8.9%, driven by biofuels. Without that component, volumes remained flat, reflecting ongoing pressure in Europe’s chemical sector. Dry bulk throughput fell by 11%, due to lower coal and construction material volumes. In contrast, there was a sharp increase in fertilizer imports. These opposing trends are linked to EU sanctions against Russia, as imports of Russian coal are completely banned, and planned additional import duties on Russian fertilizers are prompting exporters to increase their shipments.

The impact on non-containerised general cargo segments remained more limited. Conventional general cargo was less affected overall, but still declined by 4.3%, particularly due to weaker steel and iron traffic. Tightened European import restrictions on cheap foreign steel and China’s planned reduction of steel overcapacity may stabilise the European steel market in the longer term. RoRo traffic edged up by 1.4%. Although fewer new cars were shipped, this was offset by growth in truck, high & heavy equipment, and second-hand vehicle volumes. Unaccompanied freight throughput slipped by 1%, with regional variations.

US volumes on the rise, car exports under pressure

In the first half of 2025, traffic with the United States grew by 17.2% to 16.4 million tonnes. This confirms the US as Port of Antwerp-Bruges’ second most important trading partner, after the United Kingdom. At the same time, the port remains the largest European export port to the US.

Imports from the US increased by 13.1% to 9.7 million tonnes, with higher volumes in both containers and liquid bulk, including LNG and other energy gases. Exports to the US rose by 23.5% to 6.7 million tonnes, mainly driven by fuels and dry bulk. At the same time, a clear decline in vehicle exports has been noticeable since May. In the first six months of the year, 15.9% fewer new passenger cars and vans (76,089 units) and 31.5% fewer trucks and High & Heavy vehicles (11,751 units) were exported. This reflects the impact of US import tariffs.

Container exports remained stable at 303,000 TEU, while container imports rose by 12.6% – possibly indicating some level of anticipation. The outlook for the second half of 2025 remains uncertain. Much will depend on a potential trade agreement between the EU and the US by August 1st, which could restore greater certainty and predictability in the supply chain.

Jacques Vandermeiren, CEO Port of Antwerp-Bruges: “In a challenging economic climate, we continue to demonstrate our resilience as a port. The growth in container traffic proves the strong foundations of Port of Antwerp-Bruges, even as bulk traffic comes under pressure and congestion is felt across North-West Europe. Our consistently strong trade relationship with the United States confirms our role as a transatlantic gateway to Europe. At the same time, current capacity pressures and operational challenges highlight the need for additional container infrastructure. With the ECA project, we are focused on building for the future so that we can continue to support sustainable growth.

”

.png?width=1000&height=600&name=Medium-BNFW_shoot_2024%20(56).png)