Port of Antwerp-Bruges limits impact of economic instability

Market share of containers on the rise

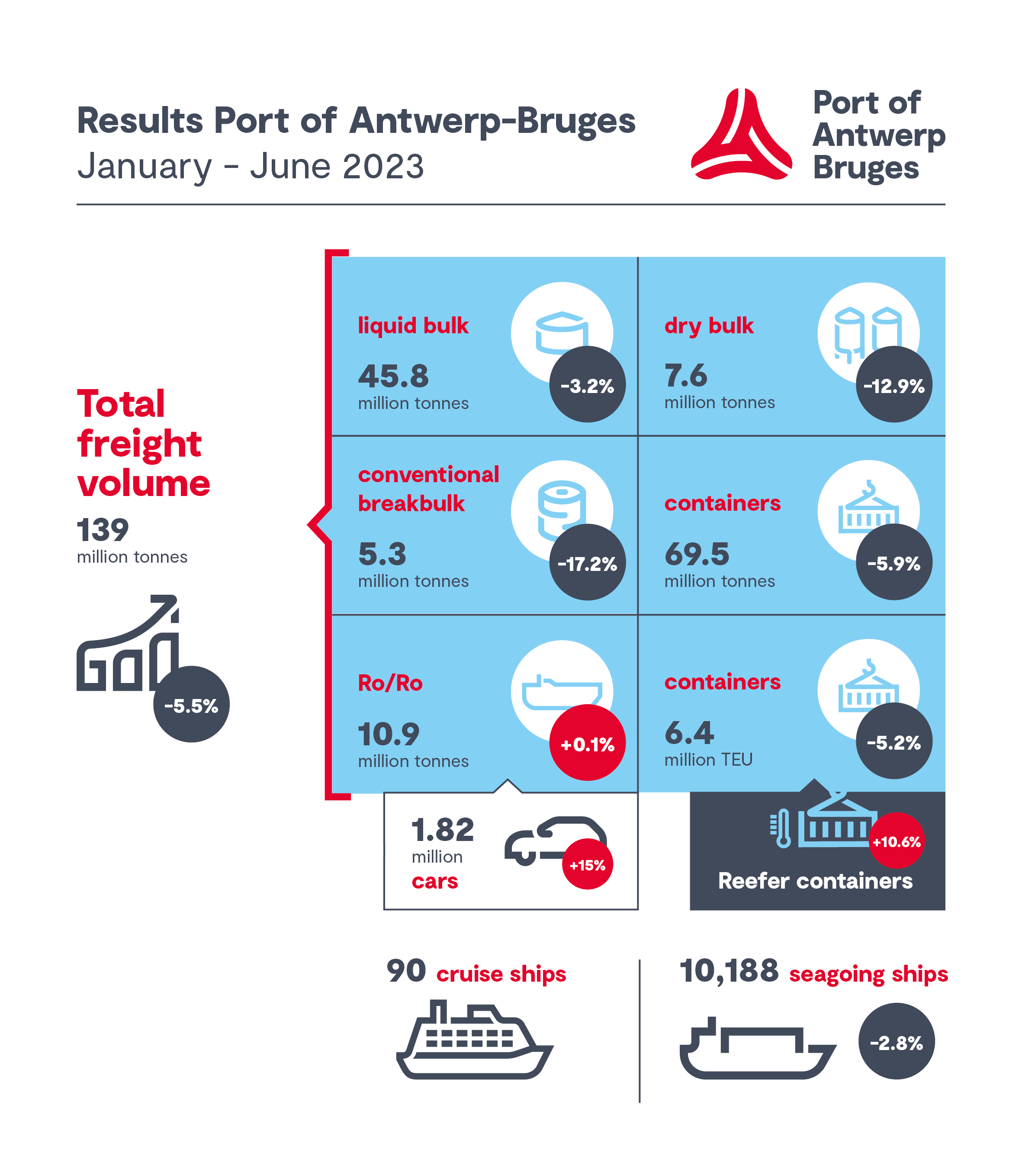

The total throughput of Port of Antwerp-Bruges was 139 million tonnes in the first six months of this year, a fall of 5.5% compared to the same period last year. While the global economic situation is causing a drop in demand for container transport, other cargo flows show a mixed picture. In the current unstable economic conditions, the port is holding up well and is also gaining market share in container handling compared to the other ports in the Hamburg – Le Havre range.

Operational challenges and congestion at the container terminals were resolved after two difficult years, with deviated cargo returning. This results in an improvement in the second quarter (-4.6% in TEU) compared to the results after the first quarter of this year (-5.8% in TEU). However, the uncertain economic situation, decreasing industrial production and low consumer confidence are leading to a global slowdown in demand for container transport of as much as 9% in the first quarter of this year. This results in a decrease in container handling at port of Antwerp-Bruges of 5.9% in tons and 5.2% in TEUs, compared to the first six months of 2022. Compared to the other ports in the Hamburg – Le Havre range, Port of Antwerp-Bruges' market share increases by 1% point to 30.6% in the first three months of 2023.

Despite the weak economic climate, conventional breakbulk is holding up quite well. Throughput volumes are in line with the pre-Covid-19 period, but down 17.2% compared to the same period in 2022, which showed exceptionally high throughput rates due to a strong post-Covid-19 recovery. The slowing economy is accompanied by a decline in demand for steel – the most important cargo group within this segment. Steel throughput, both import and export, decreased in total by 18%.

The dry bulk segment is down by 12.9%. Despite the sharp decline in both fertiliser and energy prices versus the peaks following the start of the war in Ukraine, the throughput of fertilisers – the largest product group within dry bulk – continues to decrease further (-19%) and there is little rotation of stocks. Coal throughput, which peaked in 2022 due to the energy crisis and also rose in the first quarter, is also falling sharply after a mild winter and coal surpluses in Europe (-32.4%). The throughput of sand and gravel grew by 16%.

The liquid bulk segment saw a decline of 3.2%. Liquid fuels’ throughput grew by 6.2%. This is mainly driven by strong gasoil / diesel throughput (+57%). LNG throughput remained status quo (-1.4%) compared to a strong 2022. Furthermore, throughput of chemicals fell by 15.4% due to weak global demand and reduced local and European production. The latter is mainly due to energy prices, which are still higher in Europe than in other regions.

Roll-on/roll-off traffic is continuing to see strong performance (+0.1%). In the first six months of 2023, 1.8 million new cars were shipped in and out – up a whopping 15% from 2022. Throughput of transport equipment grew by 3.6%, while unaccompanied freight (excluding containers) fell by 2.1%. Traffic related to Ireland increased by 16.7%, but traffic to and from the United Kingdom declined by 4%.

Main European fruit port

In contrast to the overall decline in container throughput, the number of reefer containers grew by 10.6% compared to the same period last year. An important part of the goods in these reefer containers is fruit: bananas, kiwis, pineapples, melons, citrus fruits, lychees, .... Handling these perishables requires the necessary expertise and specialisation, which specialised terminals, coldstores and logistics service providers take care of. They make Port of Antwerp-Bruges the most important fruit port of Europe.

In the first six months of 2023, Zeebrugge welcomed 90 cruise ships and 248,600 passengers. May and June were busy months for the cruise industry, with a wide variety of shipping companies and destinations.

In the first half of the year, 10,188 ocean-going vessels called at the port, down by 2.8%. The gross tonnage of these vessels fell by 4.7%.

Prepared for the future

In the last quarter, the port saw three record-breaking calls by the world's largest container ships, including the MSC Loreto (24,346 TEU). To continue to accommodate these ships, the port is making further investments in the economies of scale needed to remain at the top level of world ports. In addition, investments and new projects in energy transition and digitalisation will ensure that the port can achieve its ambition of sustainable growth.

Jacques Vandermeiren, CEO of Port of Antwerp-Bruges: "As with other world ports, the economic situation is still posing major challenges, and this is reflected in the figures. But in these volatile conditions, the port is holding up relatively well. The fact that, in addition, our market share is increasing is a confirmation of our resilience and strength as a merged port. What the second half of the year will bring, depends on many uncertain factors, including energy prices, which have a major impact on the chemical sector. It is at least hopeful that scheduled services that were discontinued because of Covid-19 are now being restarted, and shipping companies are choosing our port as their first port of call."

Annick De Ridder, Vice-Mayor of the City of Antwerp and President of the board of directors of Port of Antwerp-Bruges: "The calls of the record ships show that we can receive the largest container ships and handle them thanks to our investments in high-performance infrastructure at the terminals. With record ships comes sufficient container capacity. Sustainable growth and Extra Container Capacity Antwerp therefore remain priorities to ensure our position as a world port and live up to our role as the economic engine of Flanders."

Dirk De fauw, Mayor of the City of Bruges and Vice-President of the board of directors of Port of Antwerp-Bruges: "We have been a unified port for more than a year now. A port with some great ambitions, while at the same time facing some great challenges. Thanks to the two complementary platforms, we have significantly strengthened our position in the international logistics chain and as one of the main gateways to Europe, which is translating into a rise in our market share."